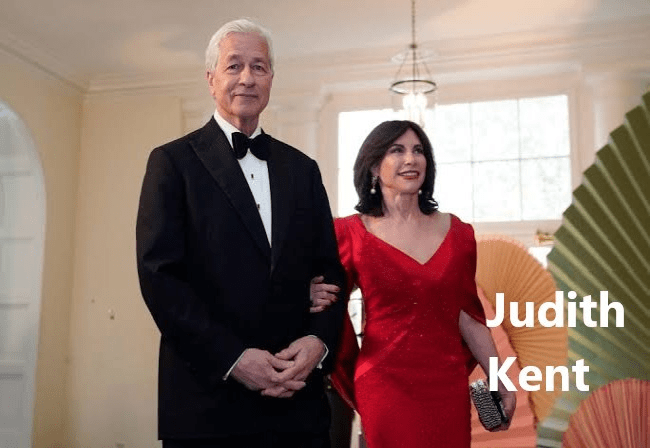

Judith Kent: Pioneering Change in Financial Education and Empowerment 2024

In a world where financial literacy is increasingly recognized as a cornerstone of personal and societal well-being, Judith Kent emerges as a transformative figure. With a deep commitment to empowering individuals through education, she has dedicated her career to demystifying finance and promoting sustainable financial practices. As we navigate through 2024, Kent’s innovative approaches and steadfast advocacy for financial education continue to inspire a new generation of financial thinkers. This article explores her journey, contributions, and the impact of her work on financial empowerment.

A Journey Rooted in Purpose

Judith Kent’s passion for financial education is not just a professional endeavor; it is a personal mission rooted in her own experiences. Growing up in a community where financial knowledge was limited, she witnessed firsthand the challenges that individuals faced when managing their finances. This early exposure ignited her desire to bridge the gap in financial literacy, leading her to pursue a degree in finance and economics.

Kent’s career began in the corporate finance sector, where she quickly recognized the disconnect between advanced financial practices and everyday financial management. She understood that while sophisticated financial strategies were available to businesses and wealthy individuals, the average person often lacked the tools and knowledge to make informed financial decisions. This realization prompted her to shift her focus toward education and advocacy, laying the groundwork for her future initiatives.

Founding Financial Literacy Programs

In 2024, Judith Kent is best known for founding several financial literacy programs that target underserved communities. Her initiatives aim to equip individuals with the knowledge and skills necessary to navigate the complex world of finance. One of her flagship programs, “Empower Finance,” provides workshops and resources tailored to different demographics, including young adults, single parents, and retirees.

Through these workshops, participants learn essential skills such as budgeting, saving, investing, and debt management. Kent’s approach is hands-on and practical, focusing on real-world applications of financial concepts. By fostering an interactive learning environment, she encourages participants to ask questions, share experiences, and engage with the material actively.

Kent’s programs have reached thousands of individuals, helping them build confidence in their financial abilities. Success stories abound, with many participants reporting improved financial situations, reduced debt, and enhanced savings. This grassroots approach not only transforms individual lives but also contributes to the broader goal of economic empowerment within communities.

Advocacy for Policy Change

Judith Kent’s influence extends beyond education; she is a formidable advocate for policy changes that support financial literacy initiatives at the national level. Recognizing that systemic barriers often hinder access to financial education, Kent has worked tirelessly to engage policymakers and stakeholders in discussions about the importance of integrating financial literacy into school curricula and community programs.

In 2024, her advocacy efforts have led to the introduction of several legislative initiatives aimed at promoting financial education in schools. Kent believes that teaching financial literacy from a young age is crucial for breaking the cycle of financial illiteracy. Her efforts have garnered support from educators, parents, and community leaders, resulting in collaborative partnerships that expand the reach of financial education.

Moreover, Kent has participated in various panels and conferences, sharing her insights on the necessity of financial literacy for fostering economic resilience. Her passion for this cause resonates with audiences, inspiring others to take action and advocate for change in their own communities.

Leveraging Technology for Greater Reach

In today’s digital age, technology plays a pivotal role in education, and Judith Kent has harnessed its potential to enhance her programs. Understanding that online platforms can reach a broader audience, she has developed a series of digital resources, including webinars, online courses, and interactive tools designed to make financial education accessible to everyone.

In 2024, Kent’s online initiatives have proven particularly valuable in the wake of the COVID-19 pandemic, as many individuals sought remote learning options. Her engaging online courses cover various topics, from personal finance basics to advanced investment strategies, allowing participants to learn at their own pace. The convenience of online access has empowered countless individuals to take control of their financial futures, regardless of their geographic location.

Additionally, Kent has embraced social media as a powerful tool for advocacy and education. By sharing tips, insights, and success stories on platforms like Instagram, Twitter, and LinkedIn, she engages with a diverse audience and raises awareness about the importance of financial literacy. Her relatable and authentic approach resonates with followers, encouraging them to prioritize their financial education.

Collaborations and Partnerships

Recognizing that lasting change requires collaboration, Judith Kent has formed strategic partnerships with various organizations, including non-profits, educational institutions, and financial institutions. These collaborations have amplified her impact, enabling her to leverage resources and expertise to reach even more individuals.

One notable partnership involves collaboration with local schools to implement financial literacy programs within the curriculum. By training educators and providing them with the necessary tools, Kent’s initiatives ensure that financial education becomes an integral part of students’ learning experiences. This holistic approach addresses the need for financial literacy at all stages of life, setting individuals up for long-term success.

Furthermore, Kent has worked with corporations to develop employee financial wellness programs. These initiatives aim to support employees in managing their finances, reducing stress, and enhancing overall well-being. By promoting financial literacy in the workplace, Kent contributes to creating a more financially savvy workforce.

The Impact of Judith Kent’s Work

As we reflect on Judith Kent’s contributions in 2024, it is evident that her work has far-reaching implications. By empowering individuals with financial knowledge and skills, she fosters a culture of financial literacy that transcends generations. The ripple effect of her initiatives can be seen in improved financial behaviors, Judith Kent reduced financial stress, and increased confidence among participants.

Kent’s commitment to advocacy and policy change has also catalyzed a broader recognition of the importance of financial education in society. Her efforts to integrate financial literacy into school systems and promote workplace wellness programs highlight the necessity of equipping individuals with the tools they need to navigate their financial futures.

Conclusion: About Judith Kent

Judith Kent is not just a financial educator; she is a catalyst for change in the realm of financial literacy and empowerment. Her innovative programs, advocacy efforts, and commitment to collaboration have transformed the landscape of financial education in 2024. As she continues to inspire individuals and communities, Kent’s legacy serves as a reminder of the power of knowledge in creating a more equitable and financially literate society. Through her work, she not only empowers individuals to take control of their finances but also paves the way for a brighter financial future for generations to come.